Products

Allied Top Industrial (HK) Limited provides advanced online forex, index and CFD trading platforms to global investors

01

什么是外汇?

FX或者Foreign Exchange,是全球最大的金融市场。外汇交易是一种货币相对于其他货币的交易。外汇市场从周一至周五可连续24小时交易,全球每日外汇交易量相当于3万亿欧元。

-

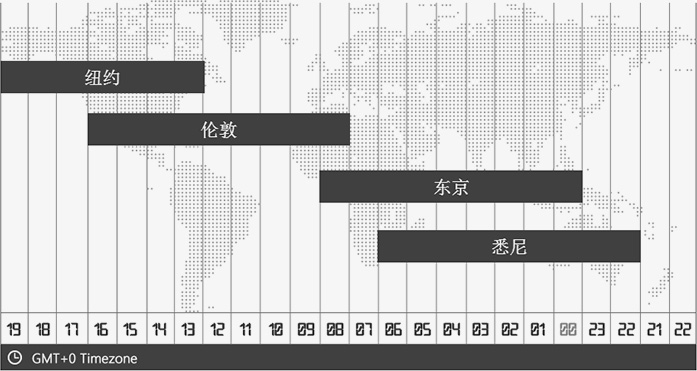

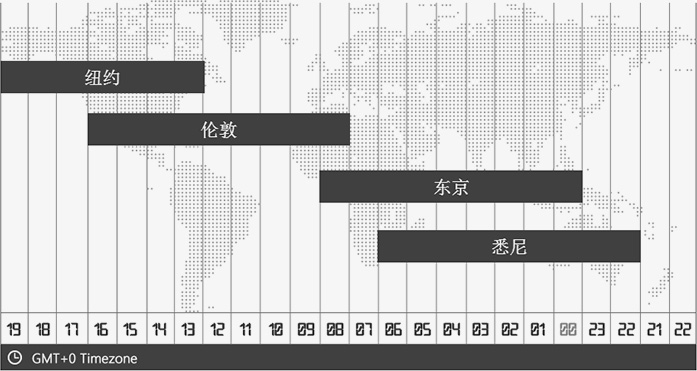

Forex trading hours:

New York forex trading hours are between 13:00 to 22:00 GMT

London forex trading hours are between 08:00 to 17:00 GMT

Tokyo forex trading hours are between 00:00 to 09:00 GMT

Sydney forex trading hours are between 22:00 to 07:00 GMT

-

Trading hours of Many institutions around the world are 24 hours a day, so there will be trading hours overlap between two places? :

London & New York [12:00 - 16:00] GMT

Tokyo & London [07:00 - 09:00] GMT

Sydney & Tokyo [00:00 - 06:00] GMT

-

Overlap trading hours are the most active time.

The forex market is more active than the stock market and traded over the counter, which means that

currency pairs is not listed on any exchange. Although most of the forex is traded in London, New

York and Tokyo, there is no major trading city. It is a real global market.

Compared with other markets, forex is popular with individual investors because of its high

liquidity. You can trade forex online in anywhere. Forex traders seek profitable price differentials

by buying or selling a currency that is up or down relative to other currencies.

Forex traders often benefit from price fluctuations caused by high liquidity and a large amount of

buyers and sellers. Forex prices are affected by macro factors. For example, the latest decision of

the central bank will affect the forex market more directly than the stock market. In forex trading,

you only need to assess whether one currency is worth more or less than another.

02

Why choose Allied Top Industrial (HK) Limited to trade forex

- The core business of Allied Top Industrial (HK) Limited is forex. The forex market is the largest and most active

financial market around the world. For investors, high liquidity and frequent price fluctuations

mean more investment opportunities.

The global daily trading volume of forex is 3 trillion Euros.

We are a global company led by a team of industry experts. We provide the best price on the market

and low latency order execution services.

We are one of the platform that provides most trading currency pairs around the world.

More than 50 currency pairs

Spreads as low as 0.6*

Up to 200 leverage

Provides 0.01 minimum lot in micro accounts

Fast order execution

Free of commission in standard account

Excellent charting function of METATRADER 5 platform

The advanced charting features of our METATRADER 5 platform is designed for real account.

You can check all the information of currency pairs on our market information sheet. If you have

never traded forex, you can learn how to use our platform with a demo account while improving your

trading knowledge on our education page.

To start a zero commission forex trading, please click on forex account opening

*Please note that the spread will vary depending on trading products

*Please note that the spread will vary depending on trading products

-

We will use EUR/USD as an example.

We will use EUR/USD as an example

One standard lot size of EUR/USD, worth 100,000 Euros.

The minimum lots in the standard account is 0.1 lots.

0.10 lots x 100,000 Euros = 10,000 Euros

In foreign exchange, the base point is the basic unit to measure exchange rate fluctuations. 0.0001

is a base point of EUR/USD.

If you buy 0.1 lots of EUR/USD (10,000 Euros), when the exchange rate rises one point (0.0001), you

will earn one dollar, because 10,000 x 0.0001 = 1 USD.

If you sell 0.1 lots of EUR/USD (10,000 Euros), when the exchange rate falls one point (0.0001), you

will earn one dollar, because 10,000 x 0.0001 = 1 USD.

If you sell 0.1 lots of EUR/USD (10,000 Euros), when the exchange rate falls one point (0.0001), you

will earn one dollar, because 10,000 x 0.0001 = 1 USD.

If you sell 0.1 lots of EUR/USD (10,000 Euros), when the exchange rate falls one point (0.0001), you

will earn one dollar, because 10,000 x 0.0001 = 1 USD.

Conversely, if the price in the example fluctuates in the opposite direction, it will cause losses.